Analysis of Trades and Trading Tips for the British Pound

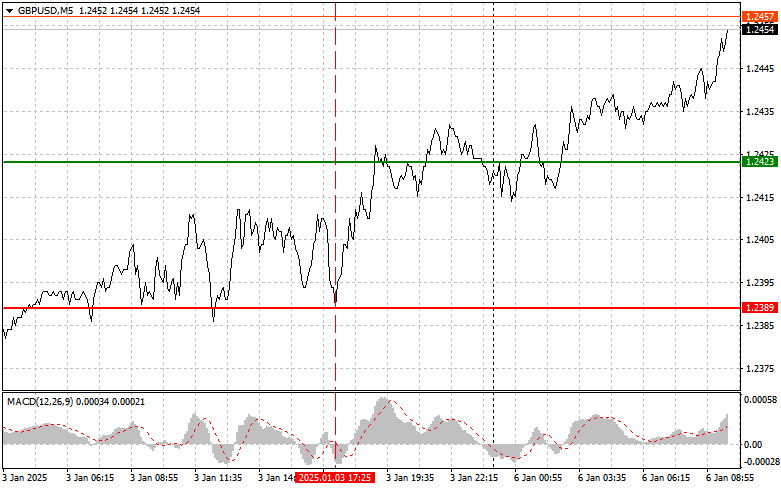

The test of the 1.2389 price level in the second half of the day occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the pound.

The release of U.S. data on Friday contributed to the dollar's strength against the pound. However, the currency pair soon began to recover. Despite the significant challenges the pound faces in relation to the U.S. dollar, buyers of risk assets may try to regain some of the losses today. This suggests that the "battle" for direction is not entirely lost.

Today's data on the UK Services PMI could be a key factor in determining market direction. If the reading falls below expectations, it will heighten investor concerns about slowing economic growth. Given that the services sector constitutes a significant portion of the UK's GDP, its weakness could erode confidence in the British pound and lead to its decline against the dollar.

The composite PMI, which combines manufacturing and services data, could also influence investor sentiment. Weak readings for both indices could put additional pressure on the Bank of England, forcing it to reconsider its monetary policy plans. The pound could face increased volatility in such conditions, especially amid growing concerns about a significant economic slowdown.

I will primarily rely on implementing Scenarios #1 and #2 regarding the intraday strategy.

Buy Signal

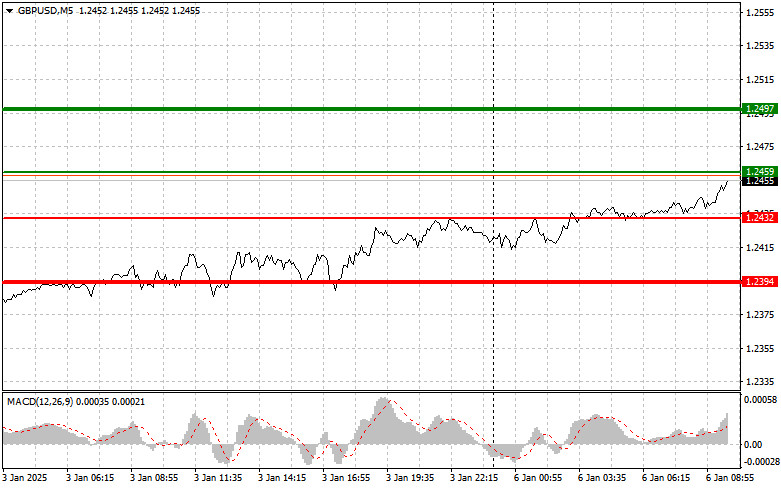

Scenario #1: Today, I plan to buy the pound at the entry point around 1.2459 (green line on the chart) with a target of 1.2497 (a thicker green line on the chart). Around 1.2497, I plan to exit the market and open sell positions in the opposite direction, expecting a movement of 30–35 pips in the opposite direction from the level. Anticipating a rise in the pound today is feasible as part of continuing the correction. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2432 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth can be expected toward the opposing levels of 1.2459 and 1.2497.

Sell Signal

Scenario #1: I plan to sell the pound after the price breaks below the 1.2432 level (red line on the chart), likely leading to a quick decline in the pair. The key target for sellers will be 1.2394, where I plan to exit the market and immediately open buy positions in the opposite direction, expecting a movement of 20–25 pips in the opposite direction from the level. Selling the pound is best done from higher levels, aiming to resume the downward trend. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2459 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected toward the opposing levels of 1.2432 and 1.2394.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.