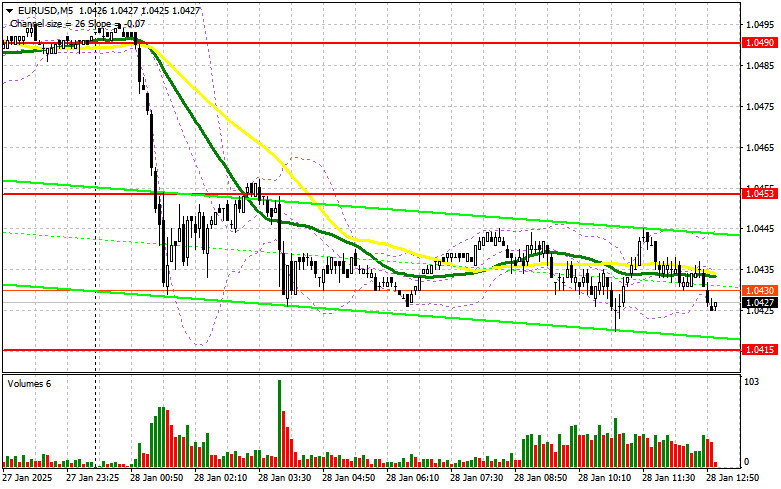

In my morning forecast, I highlighted the 1.0415 level and planned to make trading decisions around it. Let's review the 5-minute chart to see what happened. A decline occurred, but it fell just short of testing and forming a false breakout near 1.0415, leaving me without buying opportunities. The technical picture remains unchanged for the second half of the day.

For Opening Long Positions on EUR/USD:

Considering the lack of economic data from the Eurozone and the renewed pressure from Donald Trump's trade tariffs on other countries, it's not surprising that the appetite for buying the euro has diminished compared to yesterday. I hope the second half of the day will be more eventful, as key US data, including the Consumer Confidence Index, is set to be released. A strong increase in this indicator, as forecasted, could boost demand for the dollar and pressure the euro.

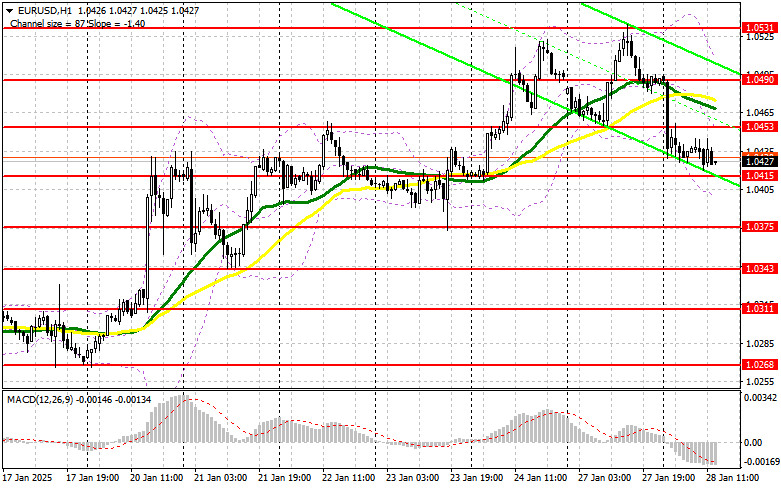

In the event of a negative reaction and a decline in the pair, I plan to act around the 1.0415 support, formed after yesterday's trading session. A false breakout at this level will provide a good entry point for a rise toward 1.0453 resistance. A breakout and retest of this range, coupled with weak US data, will confirm a proper buying opportunity with a target at 1.0490, which would be a strong response from euro buyers to Trump's recent actions. The ultimate target will be the 1.0531 level, where I will take profits.

If EUR/USD continues to fall and shows no signs of activity near 1.0415, the pair risks declining further. In this case, sellers might push the price toward 1.0375, where I plan to wait for a false breakout before buying. Alternatively, I will consider buying from a rebound at 1.0343, aiming for an intraday upward correction of 30-35 points.

For Opening Short Positions on EUR/USD:

Sellers made an attempt, but it seems that those who initiated short positions in the morning have exited the market. Now, hopes rest on strong US data, mirroring yesterday's scenario that triggered a major euro sell-off and strengthened the dollar.

The primary task for bears in the second half of the day will be to defend the 1.0453 resistance. A false breakout at this level will convince me of the return of large players, providing an entry point for short positions with a target at the 1.0415 support, which narrowly missed being tested earlier today. A breakout and consolidation below this range, followed by a retest from below, will create another opportunity for selling, targeting the 1.0375 low. The ultimate target for shorts will be the 1.0343 level, where I plan to take profits.

If EUR/USD rises during the second half of the day and bears show no activity near 1.0453, where moving averages are also positioned slightly higher, I will delay short positions until the next 1.0490 resistance test. I will also sell there only after a failed consolidation. Alternatively, I plan to sell from a rebound at 1.0531, aiming for a 30-35 point downward correction.

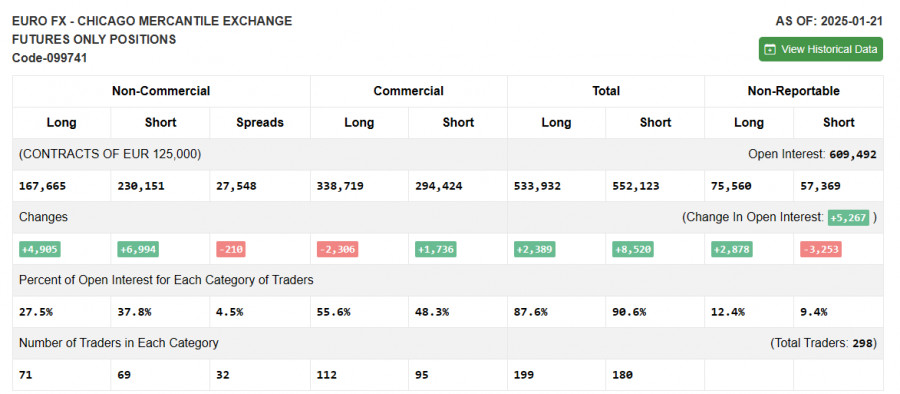

The Commitment of Traders (COT) report for January 21 revealed an increase in both long and short positions, which has not significantly altered the market's balance of power. Traders continue to favor short positions on the euro, expecting that Trump will eventually move from words to actions, leading to a significant dollar rally against the euro.

The future policy of the Federal Reserve System (FOMC) also remains uncertain. The results of the FOMC meeting will soon provide clarity, which could further strengthen the dollar's position. The COT report showed that long non-commercial positions increased by 4,905, reaching 167,665, while short non-commercial positions surged by 6,994 to 230,151. As a result, the net position gap narrowed by 210.

Indicator Signals

Moving Averages

Trading occurs below the 30- and 50-day moving averages, maintaining pressure on the euro.

Note: Moving average periods and prices are analyzed by the author on the hourly (H1) chart, which differs from the classical daily (D1) chart definition.

Bollinger Bands

The lower band of the indicator near 1.0400 serves as support in case of a decline.

Indicator Descriptions:

- Moving Average (MA): Defines the current trend by smoothing out volatility and noise. 50-period MA is marked in yellow, and 30-period MA is marked in green.

- MACD (Moving Average Convergence/Divergence): A momentum indicator that uses 12-period EMA (fast), 26-period EMA (slow), and 9-period SMA (signal line).

- Bollinger Bands: A volatility indicator with a 20-period setting.

- Non-commercial traders: Speculative entities like individual traders, hedge funds, and institutions using futures markets for speculative purposes.

- Long non-commercial positions: The total long open positions held by non-commercial traders.

- Short non-commercial positions: The total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long non-commercial positions.